2024 Form 1040 Schedule 433b

2024 Form 1040 Schedule 433b – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

2024 Form 1040 Schedule 433b

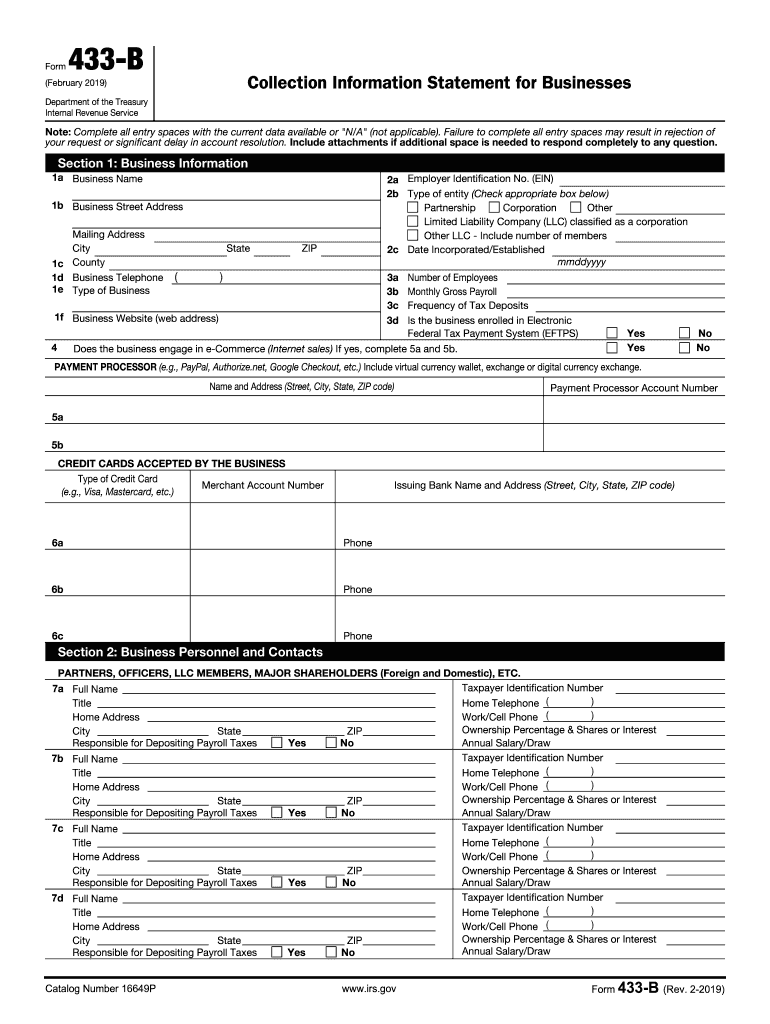

Source : irs-form-433-b.pdffiller.comIRS Form 433 B: Instructions & Purpose of this Statement

Source : taxcure.com2019 2024 Form IRS 433 B Fill Online, Printable, Fillable, Blank

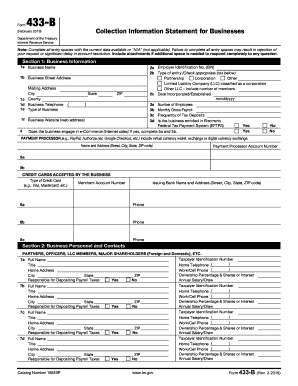

Source : form-433-b.pdffiller.comKLH Management Company

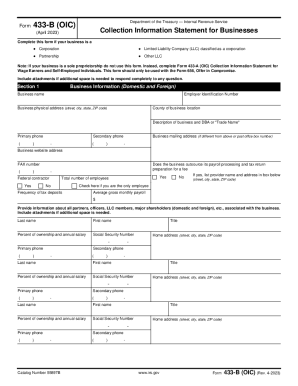

Source : www.facebook.com2023 Form IRS 433 B (OIC) Fill Online, Printable, Fillable, Blank

3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

Source : www.irs.govIRS 433 B 2019 2024 Fill and Sign Printable Template Online

Source : www.uslegalforms.com3.11.13 Employment Tax Returns | Internal Revenue Service

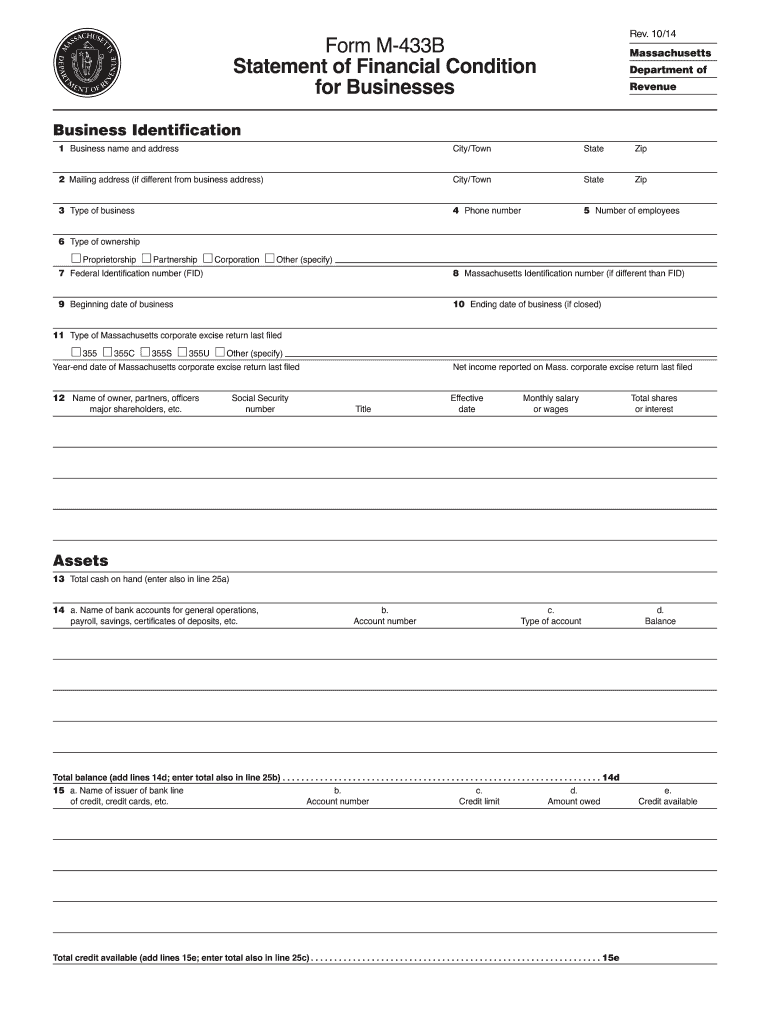

Source : www.irs.gov2014 2024 Form MA M 433(B) Fill Online, Printable, Fillable, Blank

Source : www.pdffiller.comTax Relief Solutions Archives Optima Tax Relief

Source : optimataxrelief.com2024 Form 1040 Schedule 433b 2023 Form IRS 433 B (OIC) Fill Online, Printable, Fillable, Blank : Recent changes to Form 1040 mean different filing options for seniors. Get the facts about eligibility and reporting for this new version of Form 1040-SR. Recent changes to Form 1040 mean . Schedule C (Profit Or Loss From Business) Form 1040 Schedule C is the main form that you must use to take your small business tax deductions. It contains a long list of categories for deductions .

]]>